Indexed Universal Life: Protect Your Family and Grow Your Money

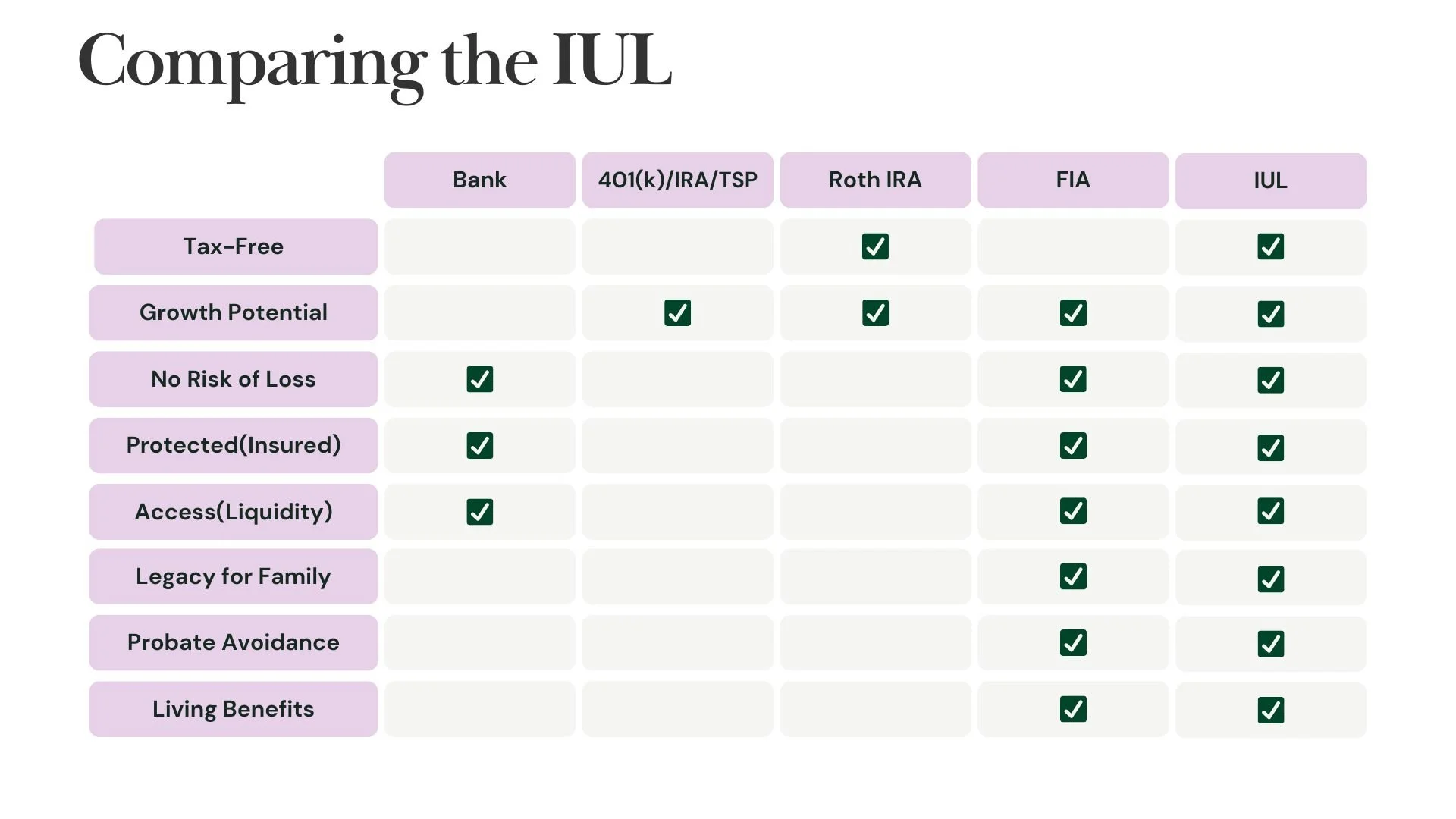

You may have heard someone mention an Indexed Universal Life insurance policy (IUL) as a tax-free retirement strategy. Maybe you thought it sounded too good to be true. After all, how can something grow tax-free, give you lifetime income, protect you from market loss — and come with life insurance?

You're right to be skeptical. But the truth is, when structured properly, an IUL can be one of the most powerful financial tools out there.

In this post, we’ll walk you through:

What an IUL actually is

How it builds tax-free income for life

What can go wrong if it’s not designed correctly

The history of IULs

Common objections — and honest answers

Whether or not it’s right for you

Let’s break it down in plain English.

What is an IUL?

An Indexed Universal Life insurance policy is a type of permanent life insurance that does two important things:

It gives you life insurance coverage.

It builds cash value that can be used during your lifetime.

Here’s what makes an IUL special: the cash value is linked to the performance of a market index, like the S&P 500 — but your money is not actually invested in the market.

Instead:

When the index goes up, you earn interest (usually capped or based on a participation rate).

When the index goes down, you earn 0% — but never lose your money due to market drops.

How IULs Create Tax-Free Retirement Income

This is where IULs get really exciting.

As your cash value grows, you can access it tax-free by taking out policy loans. These aren’t like bank loans — you’re borrowing against your own money, and your death benefit acts as collateral.

Here’s the beauty:

No taxes on the loaned income

No early withdrawal penalties

No income phaseouts or contribution limits like a Roth IRA

And your policy continues to earn interest as if you never touched it (in many designs)

With a properly funded IUL, you can create a stream of tax-free income for life, without triggering a single 1099.

What Can Go Wrong If an IUL Isn’t Structured Right?

Let’s be real: IULs have earned some skepticism — and in many cases, it’s justified.

Not because the product doesn’t work, but because it wasn’t built correctly.

Here’s what can go wrong:

1. Underfunded Policies — People sometimes only pay the minimum premium, expecting big growth. But an underfunded policy grows too slowly and may become expensive to maintain later.

Fix: Structure the policy for maximum cash growth by overfunding within IRS guidelines.

2. Unrealistic Growth Projections — Some agents show illustrations using high, optimistic return rates that don’t reflect real-world scenarios.

Fix: We always use conservative, stress-tested numbers so you know exactly what to expect in good and bad years.

3. Mismanaged Loans — Taking out too much, too fast, without proper strategy can drain the policy and even cause it to lapse — possibly triggering taxes.

Fix: Follow a safe, scheduled withdrawal plan with ongoing reviews to protect the policy’s integrity.

4. No Policy Reviews — If your policy is never reviewed, it can drift off course over the years — due to cap changes, performance shifts, or cost increases.

Fix: We provide annual reviews to make sure your IUL stays healthy and aligned with your goals.

Here are a few of the FAQ’s I get at this point in the conversation…

-

It’s not magic — it’s math, insurance law, and IRS code (specifically Section 7702). IULs follow strict legal rules, and when structured properly, they work exactly as designed.

-

Like any financial tool, there are costs. IUL fees are front-loaded and go toward life insurance coverage and administration. But over time, they’re offset by tax savings, market protection, and growth. A well-designed IUL becomes very efficient over the long haul.

-

Yes — but it’s life insurance you don’t have to die to use. The cash value is yours while you’re alive, and the death benefit is a bonus.

-

No, not from market drops. Your cash value is protected by a 0% floor. You may see zero growth in bad years, but you’ll never lose what you already earned due to a market crash.

-

Your cash value isn’t actually invested in the market — it’s linked to an index using options strategies. If the market drops, your account earns 0%, not a loss, because the insurance company absorbs the risk through conservative investments and hedging. That’s how they can offer a guaranteed floor with no market downside.

Who Should Consider an IUL?

You want to build wealth with market-linked growth

You’re already maxing out your Roth or 401(k)

You want tax-free retirement income

You want access to cash before age 59½

You want protection from market crashes

You value life insurance and living benefits

You’re a business owner or high-income earner looking for flexibility

Final Thoughts: A Smart Tool—When Used the Right Way

An IUL is not a magic wand, but when designed and managed properly, it can be one of the most tax-efficient, flexible, and secure ways to grow and access wealth.

It’s not just about life insurance. It’s about tax strategy, market protection, and retirement confidence.

Ready to See How an IUL Could Fit Your Plan?

We offer free, no-pressure strategy sessions where I walk you through how an IUL might fit your retirement or wealth-building goals. We’ll talk real numbers, real timelines, and real strategy.