Annuities: From Ancient Times to Smart Retirement Moves Today

If you’ve ever heard someone say “annuities are bad,” you’re not alone. It’s one of those financial products that people love to hate—usually without fully understanding what they are or how they’ve evolved.

But the truth? Not all annuities are created equal. In fact, the right kind of annuity—like a fixed indexed annuity—can be one of the safest and smartest places to roll over an old retirement account or a lump sum you’re not sure what to do with.

Let’s walk through the story of annuities, bust a few myths, and explore why they deserve a second look.

A Quick History of Annuities (Yes, They’ve Been Around That Long)

Would you believe annuities go all the way back to Ancient Rome? Soldiers and citizens used them as a way to receive regular income in exchange for a lump sum payment. The word “annuity” itself comes from the Latin annua, meaning “annual payment.”

Fast forward to the 18th century, and European governments were using annuities to fund wars. In the U.S., annuities started showing up in the 1800s as a way for people to create income in retirement when pensions or Social Security didn’t cover everything.

Over time, insurance companies adapted them into the modern tools we know today—some good, some not-so-great.

The Different Types of Annuities

Not all annuities are created equal—and that’s part of the confusion. When someone says, “Annuities are bad,” they usually had a run-in with the wrong type, or the right type used in the wrong way.

Here’s a quick breakdown of the main types of annuities, what they do, and why people choose (or avoid) them:

Immediate Annuity

You hand over a lump sum, and the insurance company starts sending you income right away—usually within 30 days.

Used for: Turning a lump sum into guaranteed monthly income for life (or a set number of years).

Downside: You give up access to your principal in exchange for income.

Deferred Annuity

You invest your money and let it grow over time, with income starting at a later date (usually retirement).

Deferred annuities come in several flavors: fixed, variable, and indexed.

Let’s look at those in more detail:

Why Do Annuities Get a Bad Rap?

Let’s address the elephant in the room: Why do so many people think annuities are a scam or a bad deal?

Here’s the honest answer: some annuities in the past came with high fees, long surrender periods, or were sold without much explanation. Certain variable annuities especially earned a bad reputation for being complex, expensive, and unpredictable.

But just like with anything else in finance, it’s not the product—it’s how it’s used. Not all annuities are created equal, and some of the newer options—like Fixed Indexed Annuities (FIAs)—have completely changed the game.

So… What Is a Fixed Indexed Annuity?

A Fixed Indexed Annuity is a retirement savings product designed to protect your principal from market losses while still allowing your money to grow based on the performance of a market index (like the S&P 500). You’re not actually in the market—you’re just linked to its performance.

Think of it like a safety net:

If the market goes up, you can earn interest up to a cap or a participation rate.

If the market crashes, you don’t lose anything—you just earn zero that year.

And here’s the best part: once you lock in a gain, it can never be lost. Even if the market drops the next year, your past gains stay put.

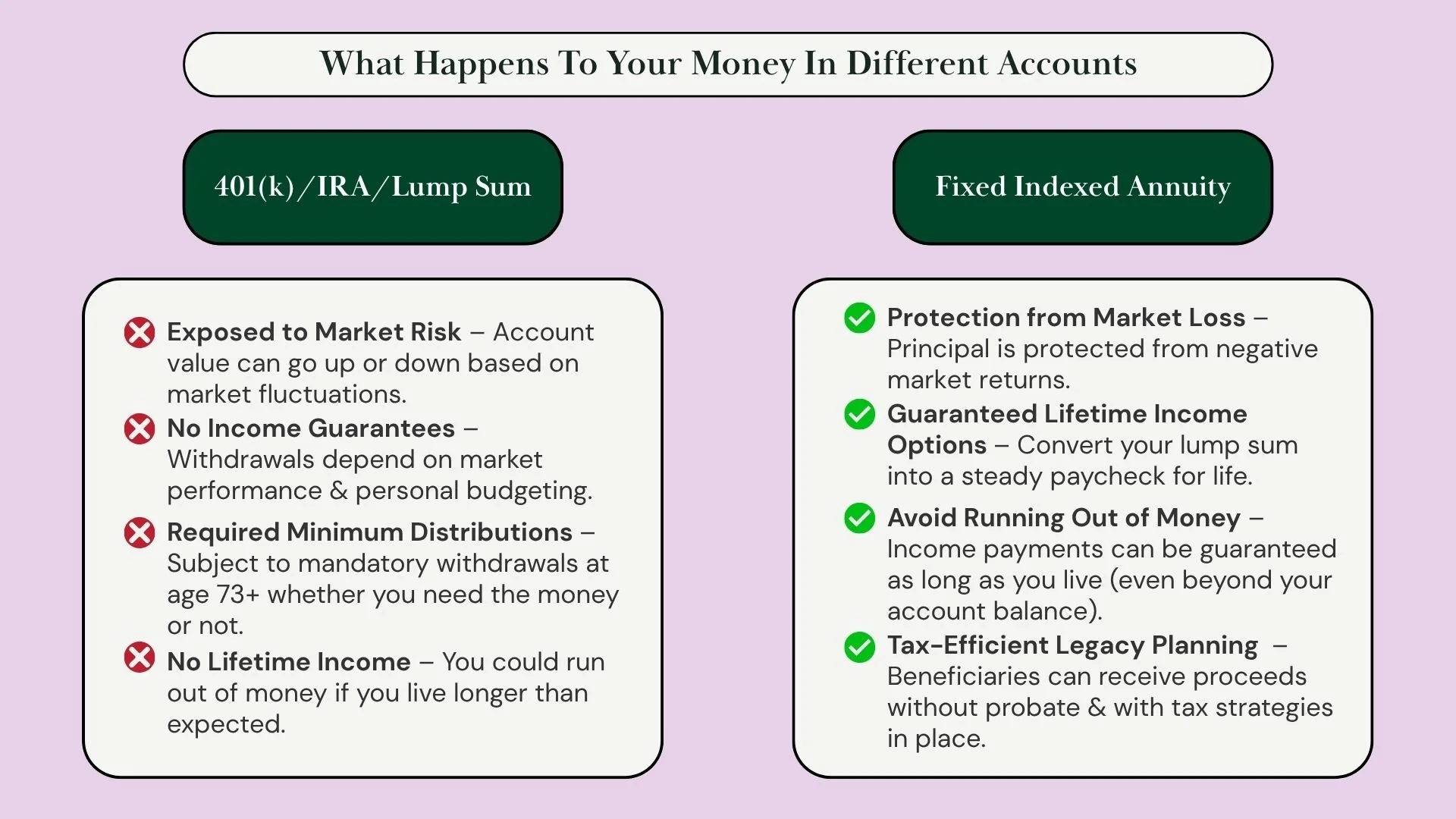

Why Indexed Annuities Are Perfect for Old 401(k)s or Lump Sums

Let’s say you just left a job and have a 401(k) sitting there. Or maybe you received an inheritance or sold a property and now have a chunk of cash. What should you do with it?

Parking that money in an Indexed Annuity offers several big advantages:

Safety—No market risk. Your principal is protected, period.

Tax Deferral—Your money grows tax-deferred until you begin withdrawals—ideal for rollovers.

Lifetime Income Option—You can turn that lump sum into a guaranteed income stream you can’t outlive—which is especially useful in retirement.

Avoid Probate—Annuities with a named beneficiary pass directly to your loved ones, avoiding the delays and costs of probate.

Zero Management Required—No active investing. No watching the market. Just set it and let it grow.

Who Indexed Annuities Are (and Aren’t) For

They’re great for people who:

Want to protect what they’ve saved.

Prefer a steady, predictable retirement income.

Are looking to roll over a 401(k), IRA, or other lump sum into something safer.

They’re not ideal for:

People who need full liquidity in the short term.

Those seeking high-risk, high-return speculative investments.

Let’s Be Real: No Product Is Perfect

Like any tool, an indexed annuity works best when it’s used as part of a bigger strategy. That’s why working with someone who understands the options—and isn’t trying to push a one-size-fits-all solution—is so important.

Final Thoughts: Annuities Aren’t the Enemy

Annuities aren’t outdated or dangerous—they’re just misunderstood. And for people nearing retirement or sitting on a chunk of savings, the right type of annuity can offer growth, protection, and peace of mind.

If you’ve got an old retirement account or a lump sum just sitting there, you might be missing out on a chance to protect and grow that money without the rollercoaster of the stock market.

Want to Explore Indexed Annuities?

If you’re curious how an indexed annuity could fit into your strategy—or if you just want to understand your rollover options—I’d be happy to help. No pressure, just a real conversation about what works for you.